risks associated with closed end funds

Closed-end funds unlike open-end funds are not continuously offered. Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund.

What Are Closed End Funds Forbes Advisor

Investment policies management fees and other matters of interest to prospective.

. What are the risks associated with Closed-end Funds. After the initial public offering shares are sold on the open market through a stock exchange. The value of a CEF can decrease due to movements in the overall financial markets.

Just like open-ended funds closed-end funds are subject to market movements and volatility. Like any investment product closed-end funds offer opportunity but also come with a number of risks some of which are listed below.

/bonds-lrg-2-5bfc2b24c9e77c00519a93b5.jpg)

Open Your Eyes To Closed End Funds

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

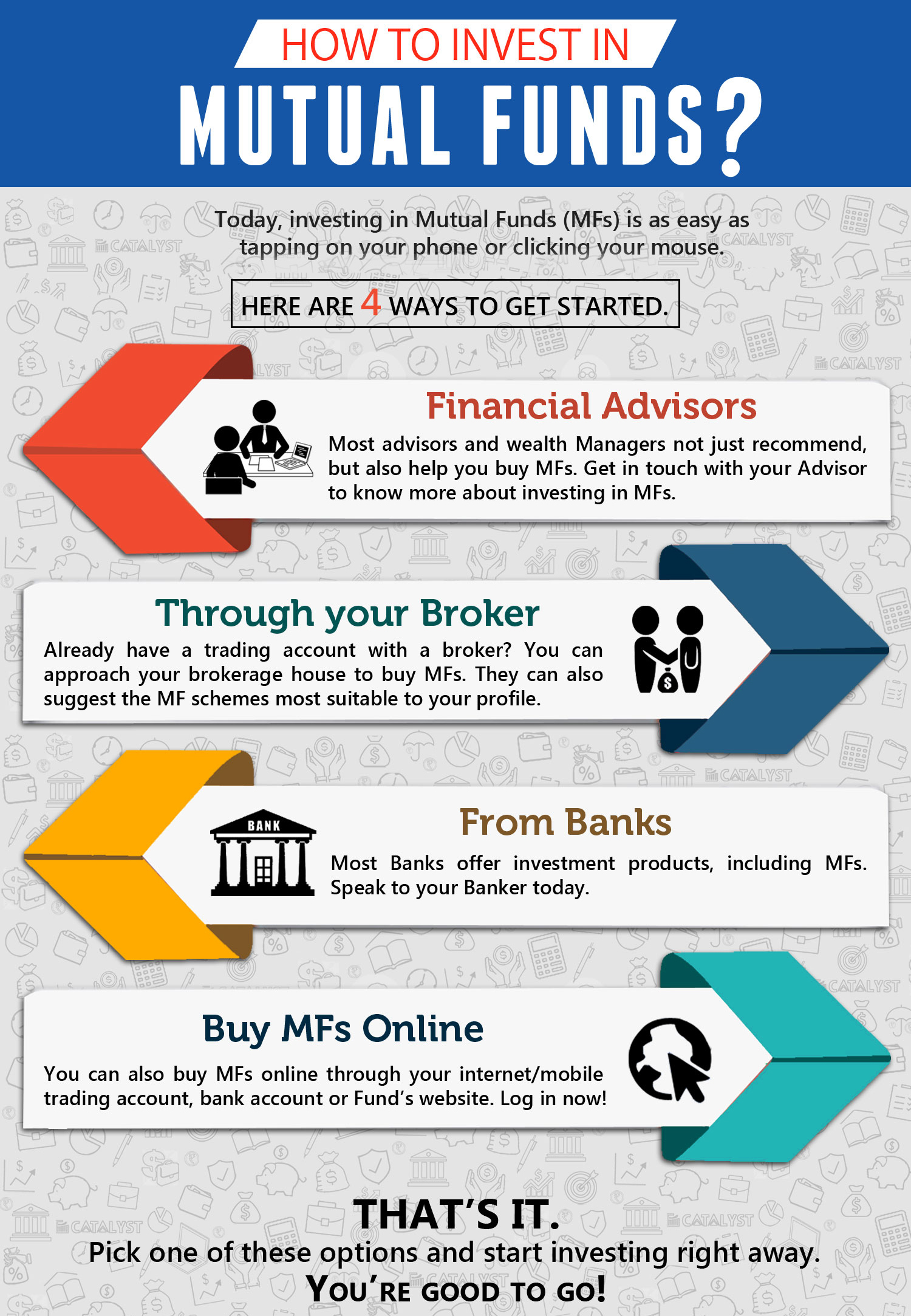

How To Invest In Mutual Funds Jamapunji

What Is The Difference Between Closed And Open Ended Funds Quora

Difference Between Open Ended And Closed Ended Mutual Funds

What Are Closed End Funds Fidelity

What Is A Closed End Fund And Should You Invest In One Nerdwallet

What Is A Close Ended Funds A Close Ended Fund Also Called Closed End Investment And Closed End Mutual Fund It Is A Type O Finance Blog Mutuals Funds Fund